The GTM Channel Conundrum—Which One Wins?

Online, Inside Sales, Field Sales, Distribution… which one’s your golden ticket?

What’s the most common GTM mistake made by startups? Thinking that if you build a great product, customers will magically appear like you’re summoning them with a Ouija board. If this newsletter has done anything, I hope it’s convinced you that sales and marketing are not intuitive—they’re complex, painful, and require actual skill (sorry, founder-CEOs). You can have the world’s best product, and still, no one shows up.

Let’s rewind. It’s 2002. I bought my first MP3 player. Not an iPod. I bought an iRiver. Never heard of it? Exactly.

Now, back then Apple wasn’t the Apple you know today—it was clawing its way back from near-bankruptcy. The iPod had a 10GB hard drive, grayscale screen, and no video. The iRiver? Color display, video playback, voice recording, 20GB of storage, high-quality audio, and a design that looked like it came from the future. So naturally, it failed. Why? Because no one could find the damn thing.

The iPod? It was everywhere—Best Buy, Circuit City (RIP), Sam Goody (RIP). It owned the shelf space. You could see it, touch it, and buy it. iRiver? You had to go on a digital scavenger hunt just to figure out how to order one online.

Here’s the point: being the best product doesn’t matter if customers can’t find you. Controlling shelf space—physical or virtual—is the difference between becoming the iPod or the iRiver. And yes, iRiver is now dead.

In B2B, shelf space isn’t as straightforward as an endcap at Walmart. It’s a chaotic, dimension-hopping, multichannel Marvel-style multiverse—e-commerce, direct sales, channel partners, inside reps, resellers. The more channels you add, the more likely they are to fight like siblings in the backseat. Each channel requires unique expertise: e-commerce (digital expertise), Amazon/Walmart (tough negotiators), direct sales (lone wolves and high SG&A on your P&L), VARs (good luck getting mindshare). They all compete with each other, and they all need their own systems, incentives, and handlers. So unless you enjoy chaos and underperformance, pick wisely.

Here’s a framework to help you define your B2B Shelf:

1. Where Do Your Customers Buy?

Amazon has 310 million users, but that doesn’t mean you can sell MRI machines there (yet). Want to sell cars? A dealership still beats a shopping cart. Find your competitor’s products. Where are they being sold? That’s your first breadcrumb.

2. Product Complexity.

The more complex the product, the more “convincing” the buyer needs. Want to sell a six-figure software platform? You’ll need a few whitepapers, some case studies, a proof of concept, and probably a steak dinner. This isn’t a “click and buy” situation.

3. Push vs. Pull.

Is your product pulling in buyers or do you need to push it down their throats? iPhones today? Pull. People walk into stores demanding them. Tesla (pre-politics)? Massive pull. General Motors’s E.V.s? Push—plus rebates, discounts, and begging.

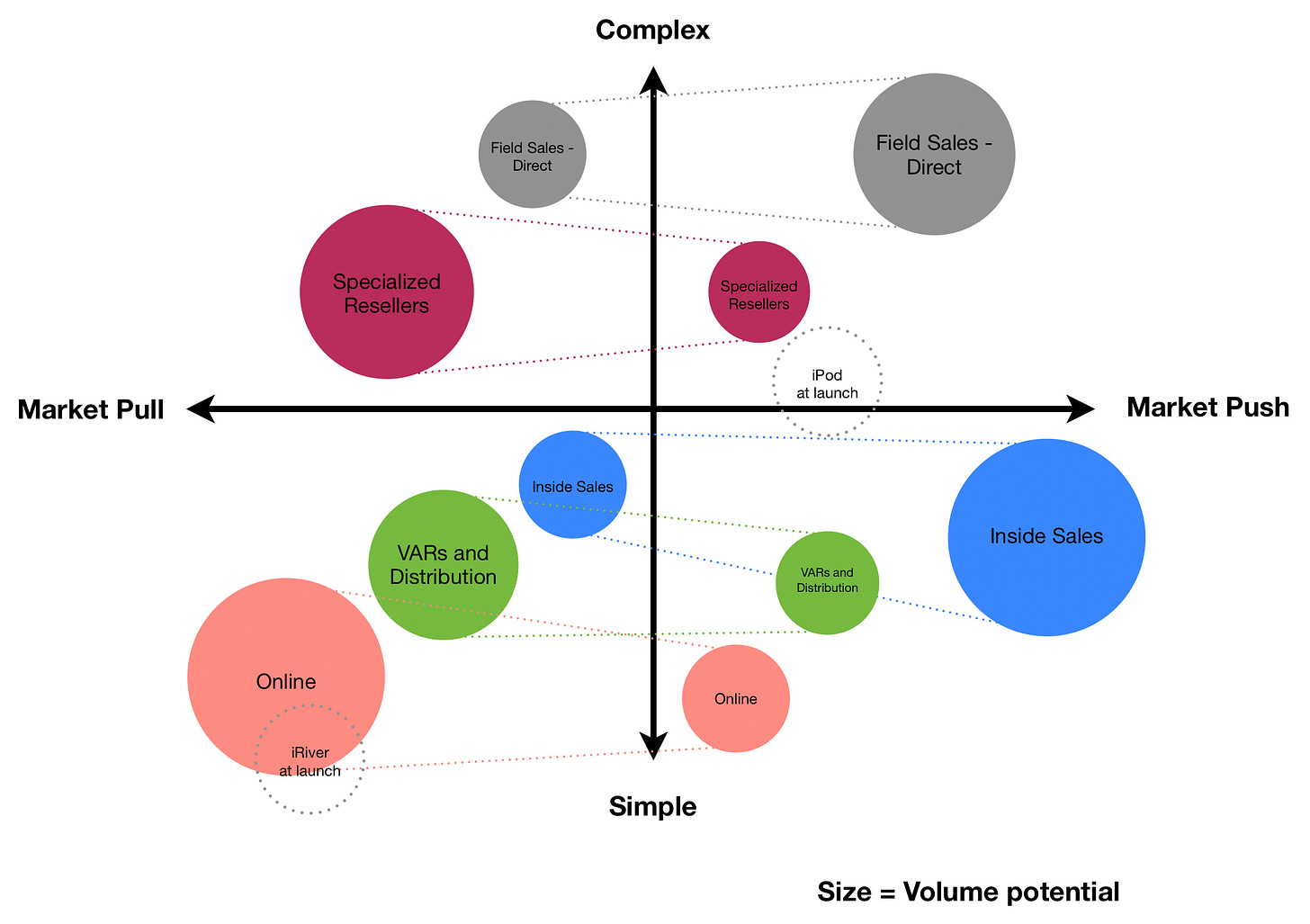

Now combine all that and map your channel strategy. See the 2-axis chart below, x-Axis: Push vs. Pull, and Y-Axis: Product Complexity.

Each quadrant demands different channels:

High Push and High Complexity: You need a field sales army and maybe specialty resellers.

High Pull and Low Complexity: Online and distribution all day long.

High Push and Low Complexity: Maybe inside sales or value added resellers.

High Pull and High Complexity: Congrats, you’ve built something magical. But you still need field sales and maybe specialty resellers.

So, what’s the moral of the story? Choosing your GTM channel mix isn’t about throwing spaghetti at the wall and seeing what sticks—it’s about knowing where your buyers are, how much convincing they need, and whether they’re actually looking for you or just squinting at a shelf full of shinier options. The graveyard of “better products” that lost the channel war is deep—don’t let yours be the next iRiver. Start with clarity, stay focused, and remember: in GTM, visibility beats virtuosity every time.

And this, dear reader, is just the start. Next week, we’ll get into the messy fun of how to actually manage each channel, structure incentives, and minimize bloodshed.

Great points. What has worked for me is identifying the differentiator, and I'll find the channel. That's where I focus my effort. Alway gave me great prospecting leverage.