Value Pricing: Profit Lever or Death Trap?

What separates the winners from the flameouts?

Margins, margins, margins.

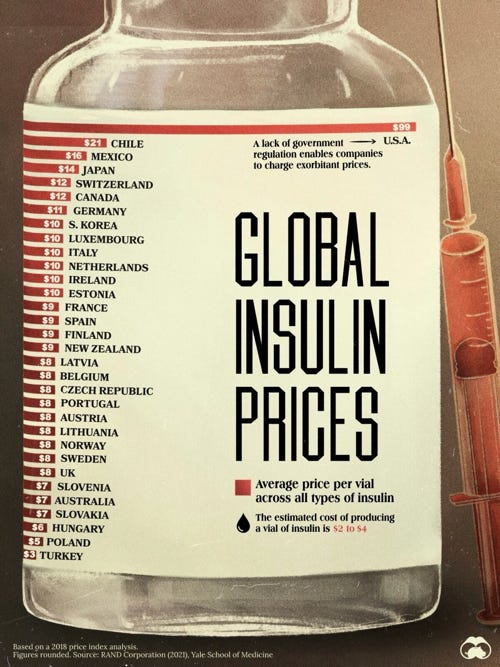

Value pricing is often seen as a silver bullet to boost profits — charging more without increasing costs. In many cases, it works. Take insulin: Visual Capitalist published a global comparison showing the U.S. on average pays $99 per vial, while Turkey pays just $3. The cost to produce it? Around $2. Regardless of the price controls or regulatory context, what stands out is how pharmaceutical companies have leveraged willingness to pay to maximize profit.

A more relatable (and less controversial) example is airfare. It’s common knowledge now that two people sitting side-by-side on a flight, getting the exact same service, may have paid wildly different prices depending solely on when they booked.

With examples like these, companies — especially in B2B — start to think, “If the airlines can do it, why can’t we?”

That’s where it breaks.

The Real Requirements of Value Pricing

Successfully implementing value pricing is not just about slapping higher prices on your products. It requires complex systems that can analyze a host of variables — competitive data, historical pricing, elasticity, segmentation — and generate actionable insights. And more importantly, the organization must be able to digest those insights into real initiatives, drive adoption, measure outcomes, and iterate. This smells like a cross-functional effort, involving GTM, finance, ops, and likely more.

Starting with systems: I’ve seen companies spend a fortune on pricing consultants (I could name a few…) only to receive a white paper full of elegant math models based on theoretical scenarios. Beautiful, academic — and utterly useless when you’re trying to make weekly decisions with messy, real-world pricing data.

This is what I call the small dog phenomenon at SMBs — a topic for a future post. But the short version: just like small dogs bark at much larger dogs without fear, SMBs try to implement enterprise-grade initiatives requiring enterprise-grade data, capital, and headcount.

Value Pricing, Scoped for Reality

There are ways to make value pricing work — if you scope it properly.

A few years back, I worked with a hardware company that launched a new B2B product for $5,000, with about 30% margins. They had an omni-channel GTM strategy, but couldn’t afford to offer distributors 25% incentives. They didn’t have dynamic pricing tools, but they did have enough operational capability to launch a bundling strategy: a premium maintenance plan, available only through distributors, that pushed margins to 60%. That was manageable — and effective.

Another example had the right idea but poor execution. A distributor with over 40,000 SKUs for contractor materials updated their pricing using competitive benchmarks and implemented auto-margin locks. Prices would go up with costs but wouldn’t adjust down when costs dropped. No review process. No alerts. So when inflation eased and competitors dropped prices, they got priced out of the market. Revenues plummeted. They’re now on the verge of bankruptcy.

It wasn’t the only mistake, but it was a big one. And it’s common. Many companies overestimate their ability to de-commoditize. If customers can easily compare your product, buy it online, and you can’t demonstrate clear differentiation, you won’t be able to sustain a price premium. One possible lever? Brand. CPG companies pull this off — we pay more for Unilever’s soap when “all soap is created equal.” But building brand equity takes years of consistent investment in marketing and customer experience delivery. And this is where we inch closer to The Sales Blame Game where the company expects sales to command a brand premium that marketing just started building. And when that fails? Reorg time.

Simplifying to Win

There are success stories, especially in services companies where deals are priced individually. A salesperson with deep knowledge of the customer can adjust pricing based on past behavior or perceived willingness to pay. But how do you scale that model when it’s all tribal knowledge?

This problem is actually more manageable. Instead of managing 40,000 SKUs, manage your top 50 customers. Another mistake? Trying to fix everything at once — every SKU, every channel, every customer. You’ll either fail outright or spend millions doing it. Instead, focus on long-term profitability for the 20% of customers who drive 80% of revenue. There are great tools — Salesforce, Hubspot and NetSuite add-ons — that can surface live reports on customer pricing and margin. And here’s the key: it’s okay to make pricing mistakes along the way. As long as you’re achieving healthy long-term profitability at the customer level, you’re on the right path. Perfect pricing at all times isn’t the goal — profitable relationships are.

With the right tools, processes, and training, your odds of success improve dramatically. Start by equipping a pricing expert with clear dashboards and well-defined metrics. Pair them with the enterprise sales team to craft customer-specific proposals that reflect real value. Then make it a company-wide effort — backed by a pricing steering committee that reviews outcomes regularly and drives continuous improvement. When pricing becomes a disciplined, cross-functional habit, not just a one-time initiative, the results are more likely to follow.

Final Thought

Value pricing is not for the faint of heart. When improperly scoped, it’s almost guaranteed to fail — especially for SMBs without the data infrastructure and human capital to support it. But with a tightly scoped strategy, cross-functional alignment, and a clear focus on your most valuable customers, value pricing can be a powerful lever to transform your margins and financial health.